随着中美之间的交流越来越频繁,中美合资企业,赴美上市企业越来越多,如果财税从业者既精通国内财税知识,又了解美国财税知识,无疑会有更好的就业机会。

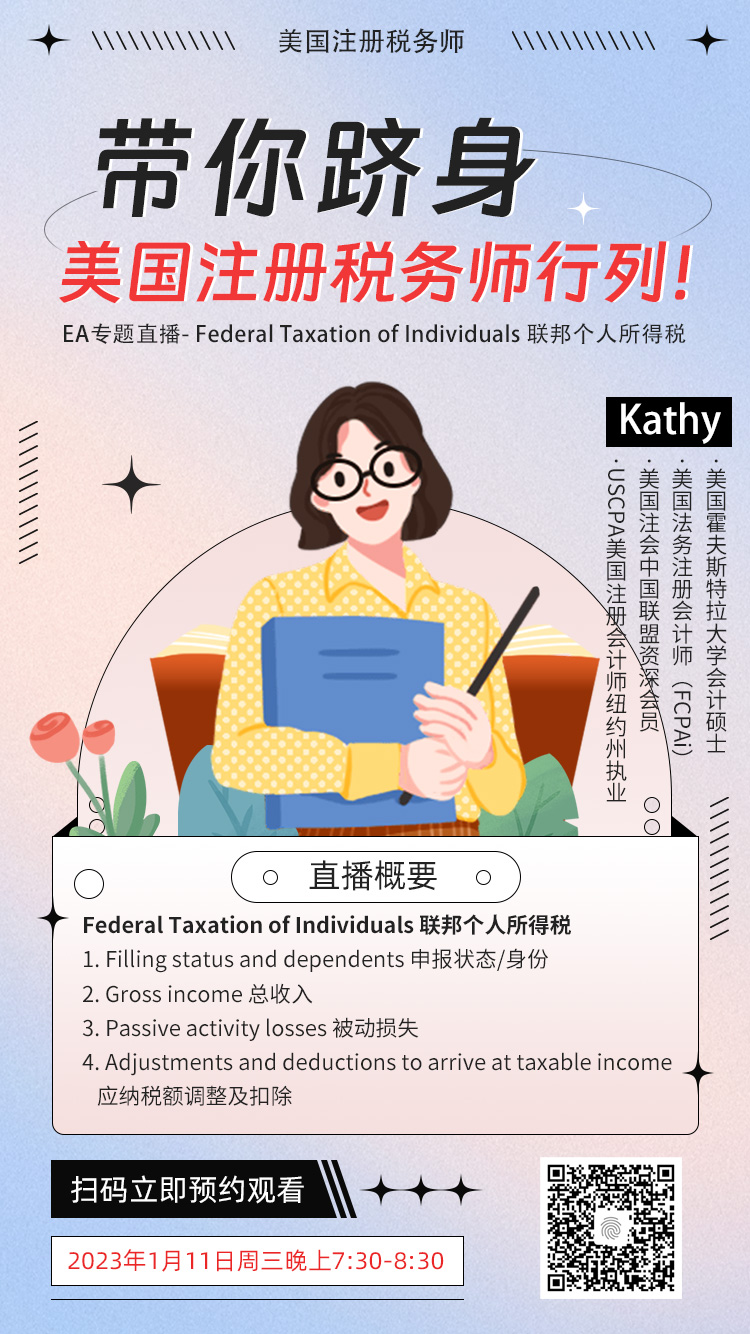

直播概要:

1. Filling status and dependents 申报状态/身份

2. Gross income 总收入

3. Passive activity losses 被动损失

4. Adjustments and deductions to arrive at taxable income 应纳税额调整及扣除

![]() 悄悄的告诉你,美国注册税务师考试的考点、知识点,跟USCPA的Regulation科目十分相似,这对于USCPA的考生和持证者来说,都是相当有利的!

悄悄的告诉你,美国注册税务师考试的考点、知识点,跟USCPA的Regulation科目十分相似,这对于USCPA的考生和持证者来说,都是相当有利的!

▼识别海报二维码立即预约▼

PC端观看链接:http://navo.top/jAbmYz

更多精彩,戳下方图片

♀️如果你对【USCPA美国注册会计师】的报考条件、补学分、Becker教材、Wiley题库、网课学习、一对一答疑、执照申请、CPE后续教育以及与其他CPA资质互换等信息有疑问,欢迎添加小财微信或点击阅读原文,为你一一解答!